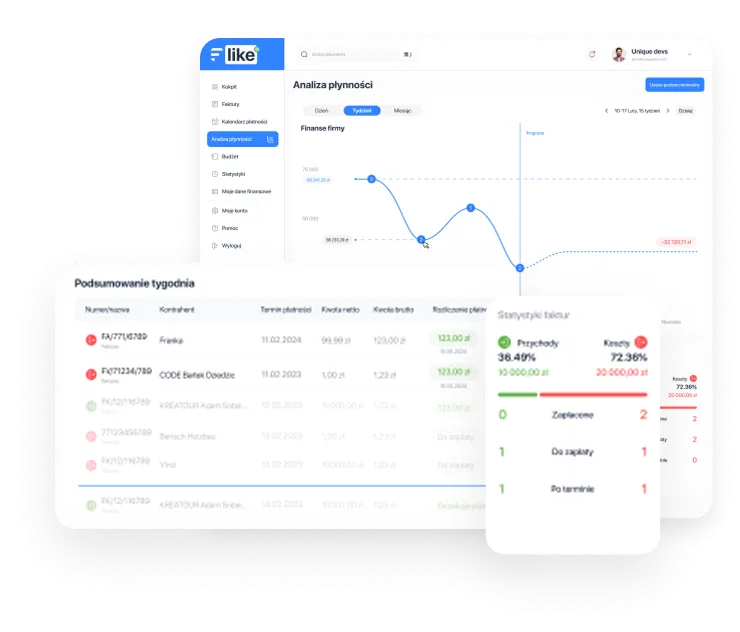

An integrated financial system for modern corporate liquidity management

An integrated financial system for liquidity management, risk analysis and budgeting — all in one intuitive tool.

Many companies struggle with issues related to cash flow management, budget planning, and monitoring liabilities and receivables. They lack a centralised tool that not only allows them to enter data, but also provides real, cumulative information for further analysis and contextual notifications to support financial decision-making.

The aim of the project was to create a modular financial system that enables the management of invoices, budgets, cash flows, and relations with contractors — taking into account real business scenarios, specific legal and tax forms, and the level of cash flow.

- Sidebar launched from a dedicated bar.

- Real-time notification list, grouped by day.

- Ability to navigate to specific resources (e.g., invoice details after clicking on a notification).

- Notification deletion.

- Well-designed UX/UI ensuring quick access without disrupting current work.

-

Assessment of cash flow:

- Coverage of fixed costs (e.g., salaries, leases, taxes) in relation to available funds.

- Coverage of variable costs, taking into account planned revenues.

-

Risk forecasting:

- The ability to set a “minimum safe amount” in the account and notify of the potential risk of falling below this value.

- Negotiation suggestions: signals to extend/shorten payment terms based on business data.

-

Cost structure:

- Share costs in revenues.

- Costs by place of origin (e.g., marketing, operations).

-

Marketing effectiveness:

- Ability to record and analyze customer acquisition costs vs. revenue generated within the budget.

-

Project analysis:

- Profitability of individual projects.

- Legal form: selection of one of the types of business activity (sole proprietorship, limited liability company, etc.).

- Taxes: selection of the form of taxation (CIT/PIT), rates, method of VAT settlement (monthly/quarterly).

- Car leasing: adding company cars with specification of the method of financing and use.

- Startup data: filling in the main account and VAT values with the start date (forced logic relative to the first invoice).

Backend

____/ NestJS + GraphQL (Apollo Server)

modular structure, high security,

easy scalability.

____/ MongoDB

flexible database, works perfectly

with dynamic data structures.

____/ AWS S3

file storage, e.g., accounting documents.

Tests

____/ Unit tests of domain logic

e.g., cash flow calculation rules.

____/ Integration

e.g., handling notifications or data completion.

____/ E2E

e.g., scenario simulation: lack of funds → notification → transition to invoice → budget planning.

Additional features

NIP verification

cron job that checks the validity of NIP numbers for companies.

KSeF verification

integration with the National e-Invoice System planned.

Administration panel

simplified frontend based on React + GraphQL, designed for user management and system configuration.

The Flike system is not just another accounting tool—it is simple but an intelligent financial assistant that supports management decisions in micro, small and medium-sized enterprises. Its well-thought-out architecture, modular design, and emphasis on usability allow the tool to grow with the company and enable more informed, predictive, and effective financial management.

- Full control over company financesincluding analysis of cash flow, cost structure, and risks.

- Dynamic, contextual notificationsInstead of searching for information, the system informs the user when a problem arises or action is needed in the future.

- Personalizationthe ability to adapt the system to the type of business, form of taxation, VAT, and other parameters.

- A solid foundation for further automatione.g., budget planning, predicting future cash flow problems.

- Increased operational efficiencyincluding through centralization of information, better reports, and the ability to respond quickly.